Hi My friends!

I am getting this one out a bit late.

At the end of the first section, Bill Buckler talks about the relevant time in history similar to ours today when the Democratic Republic of Weimar Germany went into a tailspin financially. He said that smart Germans shifted their currency out into gold-based currencies. The same financial pressures bearing down on early part of the 1900's is happening again today, only it is bigger this time.

So accurate was his model for Western economics that he was killed by jealous Stalin at the height of his late 1930's purges. Kondratieff's model is worth checking out once again especially now that we are seemingly moving right along on cue towards that predictable debt cleansing function that seems historically unprecedented in size and scope this time around.

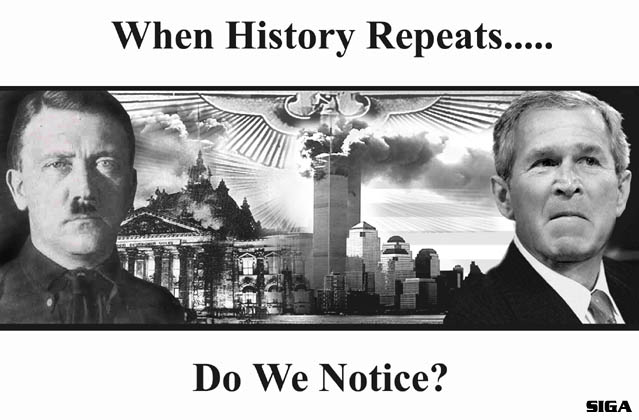

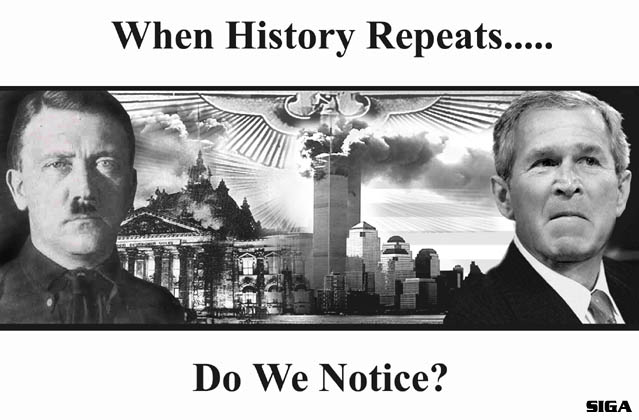

Other parallels are political. As most of us have heard, the German Republic was overrun by the Nationalist Socialists or "Nationalsozialistische", (Nazi for short) after some corrupt insiders firebombed their own Reichstagg building and blamed a foreign enemy while rolling out draconian laws internally under the guise of "Homeland Security".

Now we see the exact same play book being employed by the US as it morphs increasingly into greater corporate + state controlled politics, justifying profitable pre-emptive wars on a shifting set of continuous false proofs that insult our intelligence. Is pre-emptive war in a helpless country that happens to sit on the world's second greatest undeveloped oil patch really necessary to stop "the Reds"... er... I mean "The terrorists" who are known to be "Jews" ... er... I mean "Radical Islamists"? Total sham, a cheap re-run.

As goes the economy, so goes the politics and the masses fail to see the pattern... but there is a way out. Smart Germans knew what to do with their doomed paper assets. And you do too!

Well, enough from me. Let's move our paper to precious metals and let's monitor the obvious trends excellently laid out by the numbers below...

Cheers,Tate============================================================

GLOBAL REPORT

THE BIG GLOBAL CRUMBLE

The global economic recession is here. Worldwide, the story is nearly the same on every continent as nation after nation reels backwards from suffering a "mere" economic slowdown to actually entering a recession.

World Stock Markets Tell The Story:

All of the 23 developed nations in the MSCI World Index except Canada have made bear market plunges of 20 percent or more since September 2007 as credit losses surged and commodity prices stoked price inflation.

Stock markets discount the future prices of the shares of productive companies into the present prices of today's shares. Lower share prices signal (and in many ways give) a picture of what real economies will concretely look like in future as declining earnings are discounted.

The US second quarter now marks the fourth straight quarter of declining earnings for S&P 500 companies. Earnings have decreased 93 percent at US financial firms, 36 percent at companies that depend on discretionary consumer spending and an average 1.2 percent at commodities producers.

The US Future Price Pipeline:

Prices paid by US manufacturers for crude materials rose 70 percent over the three months ended in June. Prices for the intermediate goods made from those materials rose much less, about 27 percent. Prices for finished products made from those goods rose 14 percent, according to the Bureau of Labor Statistics Producer Price Index. US consumer prices will be next.

US companies cannot raise prices much, so they will start layoffs instead.

In The US - Somebody Always Tells You:

In June, the US saw more mass layoffs than it has in any one month since June 2003, the US Department of Labor said. There were 1,643 instances of mass layoffs affecting 165,697 workers in June. The US financial bloodletting since last summer has torn $US 2.6 TRILLION from the value of shares in the Standard & Poor's 500 Index since Oct. 12, 2007 when it reached a record 1561.80.

Some 9.6 million US homeowners now have mortgages which exceed the market value of their homes. This is up from 4.1 million homeowners with negative equity one year ago and 2.7 million two years ago.

The typical price Fannie Mae received for foreclosed homes sold in the first quarter fell to 74 percent of the unpaid mortgage principal from 93 percent in 2005. This signals DEFLATION on a massive scale.

Too Many US Losses To Count - An Example:

Merrill Lynch lost $US 2.2 Billion in the third quarter of 2007. It lost $US 9.8 Billion in the fourth quarter, $US 1.9 Billion in the first quarter of 2008 and another $US 4.65 Billion in the second quarter.

For Fannie And Freddie - This Is The LAW:

Bailout or no bailout, this is the present law for Fannie and Freddie. The two companies must hold 2.5 percent of capital against their $US 1.5 TRILLION of investments and another 0.45 percent against their guarantees of $US 3.6 TRILLION of securities. Do you feel reassured? With prices paid for foreclosed homes already down to 74 percent of the unpaid mortgage principal at the end of the first quarter, Fannie and Freddie's books are certain to be a shambles. When President Bush signs the bailout bill, it will be the American taxpayers' hard earned money which will be poured down this deflationary sink hole.

Standard & Poor's puts the full cost of a tax-funded bail-out of the two now truly "government sponsored enterprises" - Fannie and Freddie - at between $US 420 Billon and $US 1.1 TRILLION. Woe to US taxpayers! Annual American family incomes adjusted for inflation have grown by just 0.8 percent in the just over six and a half years since the end of 2001. Fannie and Freddie's combined losses over the past three quarters - that's nine MONTHS - reached more than $US 11 Billion.

Who Holds This Stuff?:

Asian institutions and investors hold some $US 800 Billion in securities issued by Fannie and Freddie, the bulk of that in China and Japan. China had $US 376 Billion and Japan $US 228 Billion as of June 2008. Europe holds approximately $US 72 billion in Fannie and Freddie debt. Investors in Britain hold $US 28 Billion. Russian buyers hold $US 75 Billion. There is $US 3.750 TRILLION of this stuff held inside the US financial system. Clearly, it was these US holders who had to be bailed out.

A Lingering Look At The Past Seven Years:

The US savings rate, which exceeded 8 percent of disposable income in 1968, stood at 0.4 percent at the end of the first quarter of this year according to the US Bureau of Economic Analysis. US mortgage debt stood at $US 10.5 TRILLION at the end of 2007, more than double the $US 4.8 TRILLION just seven years earlier. $US 5.7 TRILLION was borrowed and poured into houses in only seven years!

On top of that, Americans carry $US 2.56 TRILLION in consumer debt, up 22 percent since 2000 according to the Federal Reserve Board. The average household's credit card debt is $US 8,565, up almost 15 percent from 2000. Average household debt has swelled to 120 percent of annual income, up from 60 percent in 1984, according to the Federal Reserve. Americans are peons.

In America - Your Deposit Is "Insured" By Law:

Fannie And Freddie hold 2.5 percent of capital against their "investments" and 0.45 percent against their investment "guarantees". The Federal Deposit Insurance Corporation (FDIC) guarantees all American bank deposits up to $US 100,000 and up to $US 250,000 in certain US retirement accounts. The FDIC has $US 52.8 Billion in "reserve" to cover TRILLIONS of US Dollar bank deposits. As of June 2008, the FDIC insured US 8471 banking institutions which had total deposits of $US 8,575 TRILLION.

NOW do you feel reassured? The FDIC's "reserve" is a whopping 0.62 percent. This gargantuan financial mess has rolled through Congress in the form of a "housing bill" now signed by President Bush. Buried somewhere in the 694-page bill is an $US 800 Billion hike in the US Treasury's debt ceiling, raising it to $US 10.615 TRILLION from $US 9.815 TRILLION. The Treasury's debt "limit" has been raised by $US 1.65 TRILLION (or almost 20 percent) in the TEN MONTHS since September 27, 2007.

The Grossly Misnamed US "Treasury":

If names had any relationship to the entity they describe, the US Treasury should be called the US Debtory. The Treasury is the place where what the US federal government owes is on the record. On July 30, President Bush signed the "housing bill" which included an $US 800 Billion increase in the Treasury's debt " ceiling" to $US 10.615 TRILLION! Let the borrowing and spending roll on.

Once the Senate passed the bill on July 27, the White House sprang into action. On the morning of July 28, the Bush Administration released a revised estimate, putting the new budget deficit at $US 482 Billion for next year. The Bush Administration then had the audacity to blame the sagging US economy and all the "stimulus checks" it sent out earlier in the year for causing the increased deficit!

Piling Debts On Top Of Debts:

The US Treasury - which has just had its credit "limit" raised by $US 1.65 TRILLION in ten months, will now "backstop" Fannie and Freddie, and their $US 5.2 TRILLION of toxic paper. The only way that the Treasury can do this is to borrow even more and then hand all the borrowed money over to the two GSEs! At some point, there is going to be a form of debt revulsion across the rest of the world. When that happens, the Treasury will suddenly find one day that there are few if any foreign buyers for its paper.

The Word From The Top - "Disastrous Consequences":

"The obligations Fannie and Freddie have outstanding, something in the order of $US 5 TRILLION, are so large that there would be a worldwide financial catastrophe should they default. The financial system would seize up." So said former St. Louis Fed President William Poole in a recent interview.

The Wall Street Journal's Own Nightmare:

The Wall Street Journal (WSJ) posted a doomsday scenario should Treasury Secretary Paulson's plan fail:

"Falling house prices and nonpaying homeowners cause the value of the TRILLIONS of US Dollars in outstanding debt held by these government-sponsored enterprises, Fannie and Freddie, to plunge. Many banks have balance sheets stuffed full of this paper. They face huge losses, which some can't survive."

"They and other investors, such as foreign central banks, then dump the GSE paper."

The US Treasury's International Pawn Shop:

As The Privateer goes to press, it is clear that the entire Fannie/Freddie saga is heading toward the doors of the US Treasury. The Congress has finished festooning the Housing Bill with "other items", some of which Mr Bush has been threatening to veto for years. Yet when the 694-page bill arrived on Mr Bush's desk, he lost no time in signing it. He had no choice.

With the bill now law, the REAL crisis begins. The US Treasury is in position as a "captive buyer" of the paper from Fannie and Freddie. If US Treasury baulked even for a moment in front of the necessity to buy this paper, the "value" of the paper would plunge and the WSJ's "nightmare" would become a reality.

There can be scant doubt that right across the world - from central banks to commercial banks to insurance companies and all the rest - there are financial institutions simply itching to sell the Fannie and Freddie paper they currently hold. There was no buyer in sight before. There is now!

That buyer is the US Treasury! And that is why the Treasury could turn into an international pawn shop for Fannie and Freddie's paper. Always remember, the US Treasury can only buy if it borrows first.

A Financial Earthquake From Down Under:

An Australian commercial bank has torpedoed the world's financial system below the waterline. It has had the audacity or the dire necessity to do a massive write-down on its holdings of US Collateralised Debt Obligation (CDO) paper. The National Australia Bank (NAB) has made a debt provision for as much as 90 percent of the value of its portfolio of CDOs, most of which were derived from US mortgages - and all rated AAA! The NAB had already flagged $A 181 million in losses. It increased this by $A 830 million to $A 1.011 Billion. This is a 90 percent write down on AAA rated US paper!

The GLOBAL Ramifications:

It is not this single action by this Australian bank which matters that much, it is the global precedent which it has set. This is the first time that a write-down - of 90 percent in this case - has been done in the open for all to see. The Bear Stearns takeover by the Fed back in March was done to PREVENT this from happening. Now, it has. The news sent a thrill of fear through the Asian markets. Any matching write-down by Asian holders of US CDO paper would destroy balance sheets right across the region.

The news quickly got worse. In the US, Merrill Lynch sold $US 30.6 Billion in CDOs at 22 cents on the US Dollar. This AAA rated US paper was thereby written down by 78 percent. In global terms, a value has here been set on US originated CDOs of between 10 and 22 cents to the US Dollar!

There is Serious Work For The US Treasury:

As reported earlier in this Global Report, the true focal point remains inside the US. There is at least $US 3.6 to $US 3.75 TRILLION of this kind of paper on the books of American banks, insurance companies, financial houses, pension plans ad (almost) infinitum. All of them are now looking at matching write-downs of US originated CDO paper and assorted other US financial paper of like kinds. All of them are staring at write-downs of between 78 percent to 90 percent courtesy of the first two financial houses to face the truth - Merrill Lynch and National Australia Bank.

The Write-Down To 22 Percent:

Merrill Lynch agreed to sell $US 30.6 Billion of CDOs, the mortgage-related securities that have caused most of the firm's losses, for $US 6.7 Billion. Merrill Lynch itself provided the financing for about 75 percent of the purchase price by LENDING the new buyer the money to make the purchase.

The World Of Finance Is In A State Of "Pre Panic":

As The Privateer goes to press with this issue, there are undoubtedly untold numbers of financial people looking at their balance sheets and tallying up the difference between 78 percent losses and 90 percent losses on their investments in US financial paper of almost any and all description.

The one thing holding off a full-scale panic is the fact that President Bush has signed the Housing Law which raises the US debt "ceiling" to $US 10.615 TRILLION. The US Treasury can now come in as a CDO buyer - funding it through Fannie and Freddie - and stave off a global valuation catastrophe.

A Short Excursion On Price Maintenance Programs:

Historically, what the US Treasury has set itself up to do is a price maintenance program. It is a program to try to keep the price of certain items in the market higher than where the market would have put them. All these programs have failed when the nation funding them ran out of money. After that, the prices in question fell down to their market clearing levels. This is the fate staring the US Treasury in the face. It will only be able to maintain this charade as long as it can borrow and spend the borrowed money.

The First Rule Of Price Maintenance Programs:

This one is simplicity itself. When one discovers such a program - SELL if one should happen to hold any of the stuff whose price is artificially being held too high. This is what the US Treasury now faces. Here, Fannie and Freddie are only speed bumps on the road to the doors of the US Treasury. The second rule when one discovers a price maintenance program is to examine the underwriter of these (too high) prices. In doing so, one discovers that the program is causing ever climbing damage to their own balance sheet. The solution is to SELL the underwriter's financial paper! When the underwriter finally gives up, not only will the price of what it was trying to keep up at higher levels fall, but the underwriter's own financial paper will follow it down.

From The US Treasury To The US Dollar:

The US Treasury faces the prospect of paying nearly 100c on the US Dollar for CDO paper which is already being valued in the market at between 0 and 10 cents on the US Dollar. That huge gap will mean that this will be a VERY costly exercise. To all current holders, Americans as well as foreigners, the fact that the US Treasury is engaged in a price maintenance program is an invitation to sell this US-originated CDO paper at prices which will not be seen again. At some point in this ploy by the US Treasury, the value of its own paper will come into the spotlight. And when that starts to get sold off, the entire mess will recoil backwards towards the US Dollar. After that - there is no other place to go.

The Fast Approaching US Dollar Crisis:

A flight OUT of money is a flight INTO real goods. That is what the Germans called it during the three years between 1920 and 1923 when the German currency was destroyed. Increasingly desperate Germans started buying real economic goods with increasing speed as their currency lost value and prices of all other economic goods soared all around them. But back then, intelligent Germans had another choice right before their eyes. There were many sounder currencies in countries all around their borders.

Germans who understood this simply exchanged their failing money for Dutch Guilders, Swiss Francs, US Dollars (then fixed at $US 20.67 to an ounce of Gold), British Pounds etc.. All these other currencies were still on a Gold Standard with their currencies anchored to Gold at a fixed rate.

What is so truly important to understand today is this: What the intelligent Germans did in the early 1920s cannot be done now. There is not a single currency which is directly anchored to Gold. Not even the Euro, though the Euro's central banks and the ECB itself counts Gold as part of their international reserves. What is missing is the possibility of exchanging the Euro for Gold at a fixed rate by the simple presentation of Euro notes on the counter of any bank. The last currency with any form of connection to Gold was in fact the US Dollar at its rate of $US 35.00 per ounce of Gold, but this only held for transactions between governments and central banks. Mere mortals were not allowed to do it at all.

That last monetary connection to Gold was broken on August 15, 1971 by President Nixon. Ever since then, the world has been swimming in fiat paper money and - increasingly - simply credit money which commercial banks issue as loans. Today, a flight into real goods has already taken place. That can be seen in the huge surge of commodities, most of them priced and traded in terms of the US Dollar.

This flight away from money and into real economic goods, into commodities, is a short step away from a flight away from fiat or credit money into REAL money - into Gold. All it will take to bring that about is a massive fall in the international value of the US Dollar. Fannie and Freddie can't crash because they already have - just look at their share prices. Next in line is the debt paper of the US Treasury. Once that starts falling, the US Dollar is next in line.

The advantage of holding Gold coin now is that, as an individual, one stands with the money of the future.

THE NEW TWENTY-TWO CENT STANDARD

It didn't take long after Merrill Lynch had announced its CDO write down before others inside the US had to follow. In Merrill's case, the CDO's were originally valued at $US 30.6 Billion. By the end of the second quarter, Merrill had written them down to $US 11.1 Billion. It sold them for $US 6.7 Billion.

The BIG Write-Down:

Merrill's price of 22 cents on the dollar is now the new standard. Then came all the others. Citigroup's chief financial officer said that many of the bank's CDO's are valued at 61 cents on the dollar - for now. Other mortgage assets at Citigroup such as "mezzanine" and high-grade CDO's are marked closer to Merrill's 22-cent level. Bank of America, told The Times of London that the bank is taking Merrill's sale into consideration. Bank of America values its CDO's at 44 cents on the dollar. But since Merrill Lynch lent the buyer Lone Star $US 5 Billion so it could buy the CDOs (Lone Star supplying the other $US 1.7 Billion), Merrill Lynch is in effect selling the CDOs for slightly less than 6 cents on the dollar.

That 6 cents is in fact lower than the write-down which National Australia Bank did to 10 cents.

The US Mortgage Price Maintenance Program:

Fannie Mae, the largest US mortgage finance company, said its portfolio of mortgages expanded at a 23 percent annualised rate in June, the fastest pace since 2003. Fannie's holdings had risen by $US 12.7 Billion to $US 749.6 Billion. Freddie Mac said its mortgage investments expanded at a 33 percent annual rate to a record $US 792 Billion. Note that these buying sprees by Fannie and Freddie took place well before Congress passed the Housing Bill and President Bush signed it into law. Bush has done that now. The authority for the Treasury Department to help Fannie and Freddie is limited only by the debt ceiling which was raised $US 800 Billion to stand at a record $US 10.615 TRILLION.

From here on, these write-downs will not only act as benchmarks, but they will force many financial institutions across the US to come forward with their own write-downs should they also hold any CDOs on their books. Internationally, the same is the case. Here too, there are many banks and other financial houses which hold all kinds of US financial paper including CDOs. In the weeks ahead, they will have to come clean. Worse, such write-downs of US paper will increase the world's suspicions about all other kinds of US paper - including US Treasuries.

The US Treasury Is On The Critical List:

Internationally, there are two things to watch for: First, watch the US Treasury refunding exercises to see whether foreigners still show up to buy the US debt offerings. Second, keep a close eye on the yields on US Treasury bonds, notes, bills etc. to see if US interest rates start to climb in the secondary market. That is likely to be the first signal that foreign holders of US Treasuries are starting to actually sell!

The US Dollar Price Maintenance Program:

Merrill Lynch has warned that the United States could face a foreign "financing crisis" within months as the full consequences of the Fannie Mae and Freddie Mac mortgage debacle spread throughout the world.

The US depends on Asian, Russian and Middle Eastern nations to fund its $US 700 Billion annual current account deficit, leaving it HIGHLY vulnerable to a collapse of confidence. Obviously, were this foreign buying of US Dollars to end, not only would the US current account deficit stand unfunded but the US Dollar would stand naked. The US Dollar could crash!

JAPAN'S ECONOMY CONTRACTS - AND - CHINA HAS RETURNED

Japan's industrial output fell 2 percent in the single month of June from the previous month on declining worldwide demand for passenger cars and factory equipment, the government said on July 30.

Any 2 percent fall in industrial output is drastic in real economic terms. In global terms, it shows very clearly that international trade is contracting at a high rate of speed. Inside Japan, layoffs and inventories are climbing as is unemployment. Japanese consumer spending has likewise contracted in the past few months. On a GDP basis, Japan is on the verge of economic recession and could be there soon.

A Bad Sign Of The Times:

The world trade talks held by the World Trade Organisation (WTO) collapsed on Tuesday, July 29, after seven years. The spectre of the dirty thirties is again raising its head. Back then, nations barricaded themselves behind trade walls while at the same time trying to maintain their exports by plowing massive subsidies behind them. Today, global food trade is already affected with at least 65 nations placing new export barriers in an attempt to keep their own internal food prices lower than they otherwise would have been. The old result of this is already apparent. By disallowing farm exports to the higher priced markets, these nations are lowering the living standards of their own farmers and food producers. Meanwhile, in the nations where the food no longer arrives, prices for consumers are higher than they would have been. In one place farmers and food producers are poorer, in the other, the consumers are.

A Late Warning From On High:

Mr Hiroshi Watanabe, Japan's chief market regulator, rattled the markets when he urged Japanese banks and life insurance companies to treat US agency debt with caution. The two sets of Japanese institutions hold an estimated $56 Billion of Fannie and Freddie paper as well as US subprimes and CDOs. The warning came too late. Merrill Lynch has already invoked the 22 cent rule. The Japanese write-downs and the broader write-downs across the Asian markets will arrive over coming weeks. Late this week, as The Privateer goes to press, there are already stories appearing in the Asian press that "authorities" and even central banks in Asia are stepping into the breach as the losses on Merrill's 22 cent rule have already forced some Asian financial institutions to the wall. If many nations in Asia start to paper over the losses they now face on their US financial paper with new money creation, the result would be an upward explosion in Asian consumer prices. If they don't paper over these losses, that would ensure a wave of bankruptcies across their financial sectors from banks to life insurance companies.

China - BEFORE And AFTER:

Before and after the Olympic Games in Beijing, that is. Beijing has made it abundantly clear that it will let nothing and nobody stand in the way of making these Olympic Games a thunderous success. This is China's way of saying that it has returned to claim its rightful place amongst the great nations in the world. The Olympic Games run from August 8 - 24. The world will have a form of a timeout from all its present troubles. In China, once the afterglow fades (assuming there is one), the door opens for several possible drastic changes in policy. First amongst these changes will undoubtedly be a reassessment of China's present policy of the central bank "swallowing" inflowing US Dollars as fast as they arrive.

This policy has led to the enormous increase in China's holdings of foreign exchange, now standing at $US 1.81 TRILLION. Buying US Treasuries and Agency paper from Fannie and Freddie is a certain losers' game. The Chinese know this, having complained bitterly about their US Dollar losses.

If the Chinese government decides to do a flight into real goods, it will buy resources all over the world.

EUROPE IS ON VACATION - COME BACK IN SEPTEMBER

It happens just about every year in Europe around this time. Anyone looking for political, economic, financial or strategic news will find none in the European papers. Europe is on vacation!

All (Nearly) Quiet On The European Front:

Such news as is to be found primarily deals with international events - and even this is scarce. What is to be found mainly deals with national internal events of a secondary order. Here, one could say that this is a version of "no news is good news".

In a way, this is true. Europe is doing quite well thank you. The European Central Bank (ECB) though, is somewhat of an exception to this. Barely a week goes by without one, or several, of its top people saying that inflation is still a danger and that the ECB is vigilantly watching price developments.

On The Shores Of Geneva:

The world trade talks held by the WTO collapsed in Geneva on July 29 after seven years of trying. That did get some in depth coverage, but the undertone was complacent. The Eurozone alone contains 320 million people. The broader European Union (EU) has about 510 million people. The EU internal market is one of the economic giants. The European press is contending that Europe can stand alone.

In The Offices In Brussels And Moscow:

In fact, Europe can't stand alone, and the Europeans know it. As reported in recent Privateers, Russia and the EU are engaged in detailed talks involving the strategic and geo- strategic balance in Europe and everything else on the economic front - from property rights and the right to make any kind of investments in each other's territories up to (perhaps) making the Ruble a reserve currency in its own right and a partner currency to the Euro itself. Here, the Europeans want a grand deal with Russia and the Russians too want it with Europe. Politically, it is simply a case for both Russia and the European Union of getting from here to there - "there" being the final treaties.

A Grander Geo-Political Design - From Moscow:

Meet - "EATO"! Russian President Medvedev's plan, announced in Berlin last month and reported upon and analysed in The Privateer, has been and is being covered in the Russian media at full volume. It would redesign Europe's security system from the bottom up. This time, Russia would participate as an equal partner and a co-founder of the new bloc. Russian foreign policy experts are dubbing the new concept "EATO" (Euro-Atlantic Treaty Organisation). Clearly, this grouping would replace NATO.

Note here that the US has not (repeat - NOT) been excluded by Russia. Instead, Russia is aiming at making the United States one of the three legs on this vast geo-political design. But the price the US will have to pay is that NATO is disassembled - just like the Warsaw Pact was more than a decade ago.

Russian President Medvedev has repeatedly said that one of the main aims of his Presidency will be to establish a strategic partnership with the European Union that could be the mainstay of: "A Big Europe without dividing lines. The existing architecture is in crisis, and it isn't working. We need a new design, with an emphasis on security for all countries in Europe." Europe and Russia are now working on this.

In Washington, there have been no expressions of even a passing interest in any of this. In fact, the US is not involved even as observers! But Washington knows that disassembling NATO ends the US Empire.

WAIT FOR THE OFFICIAL SIGNAL - THEN PANIC

In the face of the debacle in Australia's main banks, the Rudd Labor government has already panicked. It has sent its Treasurer, Mr Swan, out to tell everybody else not to (panic, that is)! The Rudd government is now counselling against a panic as massive billion dollar write-downs by Australia's leading banks raise fears about the safety of Aussies' savings and investments. Australia's five biggest banks have now lost a combined A $29.1 Billion of market value after National Australia Bank (NAB) and Australia & New Zealand Banking Group Ltd. (ANZ) unveiled their bad loan provisions. ANZ raised its provisions for the 2008 financial year by a further $A 1.2 Billion, taking the total write-off to more than $A 2.1 Billion. Earlier, NAB made a provision for as much as 90 percent of the value of its portfolio of CDOs which were derived from US mortgages and rated AAA. That ignited the storm.

The NAB had earlier announced $A 181 million in losses. It has now increased this by $A 830 million to $A 1.011 Billion. One can hardly wait for the rest of the "big five" Aussie banks to report their positions.

A Spreading Contagion:

Worse is coming. New data now shows that superannuation funds have turned in their biggest losses since superannuation became compulsory in 1992. Business confidence has fallen to its lowest level since the 1991 recession. The latest figures show $A 60 Billion has been lost from all balanced funds.

Balanced funds make up about 90 per cent of Australian superfund investments. Now, here come reports that Australia's property market is cratering. Australian Property Monitors have found sharp price reversals across the land. It is now predicting a 10 per cent fall in house and unit prices this year with prices in all the capital cities softening in the June quarter. First the banks - then super - now houses.

Retail Is Being Routed:

Aussie retail sales have fallen for the second quarter, marking the first consecutive decline since 1996. Quarterly nationwide retail sales volume (inflation taken out) fell to negative 0.6 percent from negative 0.1 percent in the previous quarter, the Australian Bureau of Statistics reports.

A Stress Test Of The National Paycheque:

The number of Australians who spend more than half of their income repaying their mortgages has more than doubled the past year, the Australian Financial Review reported. Twenty- five percent of people with mortgages use more than half their income on payments. That is known as "mortgage stress". The figure was 12 percent a year ago. There are now about 837,000 households experiencing some form of mortgage stress, up from 784,000 in May. With house prices starting to fall across the nation, there will be many Australians tempted to walk away from their houses, handing the banks the keys.

Where The Australian Economy Is NOW:

As far as the FACTS are concerned, the Aussie economy is imploding. But what truly matters on a larger scale is Australia's situation internationally. Australia is rolling out an annual current account deficit of 6.2 percent of GDP despite having the best terms of trade since the end of WW II. Such an external deficit has to be funded from offshore - Australia must borrow the money internationally. What happens when foreign lenders refuse to lend more money? The doors for getting more international loans are starting to close. The NAB had to cut a planned $A 850 million bond sale by two-thirds after its credit market losses. International investors "elected not to proceed". The Aussie Dollar will crash if foreign creditors take this one step further and show up asking for their money back.

THE CREDIT CRISIS - A YEAR OLDER

"On Monday, August 6, the 'word' spread across Wall Street like a firestorm. ...The 'word' was that Fannie and Freddie would buy the toxic sludge in mortgages, subprimes, etc. and take it off the banks' books. There is only one very basic economic/financial problem here. In order to do this, both Freddie and Fannie will have to borrow before they can buy the toxic sludge off the books of the US lenders of same. The question is: 'Who will lend Fannie and Freddie the new money with which to do this?'"

(The Privateer - Number 584 - August 12, 2007)

For most of the year since that was written, it was US individuals and financial institutions along with foreign governments and "sovereign wealth funds". Now, the lender of last resort is in fact what it was always presumed to be - the US Treasury - aided and abetted by the Fed, the US central bank.

As we enter the second year of the global "credit crunch", the only immediate "relief" in sight is the coming distraction of the Beijing Olympics which start next Friday (August 8). The day after the Olympics ends, the Democratic convention convenes. Then, on Labor Day, the Republican convention convenes. After that comes the campaign. It is a very safe bet that the chasm between the real state of the US economy and financial system and that portrayed by BOTH Mr Obama and Mr McCain will be at its widest ever. It is an even safer bet that there will be no debate on any item of fundamental economic or financial importance. The disconnect between politics and reality will be all but total.

In short, it will be political business as usual. The facade which has stood between economic reality and public perception in the US has been shaken with each new intensification of the credit crisis over the past year, and with each new "liquidity injection" and/or bailout. We have come a long way in the year between the "glitch in the road" comment made by President Bush in 2007 and the "Housing and Economic Recovery Act of 2008" he signed on July 30, 2008.

The "Concern" For The American Taxpayer:

Treasury Secretary Paulson did not want to wait until the end of July for the passage of this "housing bill". As we reported in our previous issue -

"The major 'sticking point', according to the Democrats who chair the various financial and banking oversight committees, is to include safeguards to 'protect the American taxpayers'."

Please note carefully the term

"American taxpayers".

The term is exact, extracted from quotes from prominent Democrat (and Republican) Congressmen and Senators in the lead up to the passage of the bill. One would have thought that "American homeowners" or "American citizens" or just plain "Americans" would have been more "politic" and more appropriate.

The sad fact of the matter is that to those who make up the government, in the US and throughout the world, the citizens of the nation they govern are regarded as little more than "milch cows". One can measure the "concern" of Washington DC with the well-being of their "taxpayers" quite easily. Take a look at the Treasury's debt (and the new "limit" placed on this debt) and remember that ALL of it is underwritten by the ability and willingness of Americans to go on producing wealth and paying taxes.

Washington DC is certainly very concerned indeed about the American "taxpayer". In the final analysis, they have no other source of REAL wealth to draw on. Every rate cut, every new "liquidity injection", every bailout - all of them following one after the other with increasing rapidity as the past year has unfolded - has taken place on the unspoken assumption that there is something of real "value" behind it. When one hears the phrase - "The Full Faith And Credit Of The US (or any other) Government", reflect for a moment. Who underwrites both the "faith" and the "credit"? Only that dwindling proportion of the population of any nation who produce more than they consume. In short, the taxpayer.

SOMEBODY Has To Spend:

Mr Obama contends that the US cannot afford not to. He is promising "major initiatives" on health and energy and education - along with "middle class" tax cuts, of course. Mr McCain agrees on the need for the government to go right on spending, if not on the areas where the spending should occur. He is promising to renew ALL of President Bush's tax cuts which are due to "expire" at the end of 2010. Along with that, of course, Mr McCain promises to maintain and even ramp up the "war on terror" presently taking place in Iraq and Afghanistan. There is no change here. According to both presidential contenders, their function is to spend. The function of the American "taxpayer" is to underwrite it.

The one certainty in all this is that the profligacy of government cannot be "underwritten". When Mr Bush inaugurated his tax cuts in 2001, his government was projecting a budget surplus(!) of $US 1.288 TRILLION over fiscal years 2001-2004. In fact, over that same period, the US Treasury's debt "subject to limit" increased by $US 1.8 TRILLION. "Mistakes" of this magnitude - over $US 3 TRILLION between "projection" and FACT - are not made accidentally.

When Mr Bush was inaugurated in January 2001, the Treasury's debt "subject to limit" stood at $US 5.64 TRILLION and the debt "limit" stood at $US 5.95 TRILLION. The latest figures, as of July 31, 2008, are a debt "subject to limit" of $US 9.52 TRILLION and a debt "limit" of $US 10.615 TRILLION. Those two figures are up 68.8 percent and 78.4 percent respectively.

The difference is that up until last August when the credit crunch hit, ALL facets of the US economy - government, business and consumer - were borrowing and spending up a storm. Today, the only one of the three engines of modern economic "growth" via credit expansion still functioning is the government. The measure of the desperation of the government to perpetuate the credit expansion is the simple fact that they have raised the US Treasury's debt "limit" by $US 1.65 TRILLION in less than a year.

The official "projections" made by the Office of Management and Budget are now pointing to a deficit of more than $US 500 Billion in the fiscal year which starts on October 1, 2008. Remember, this is the same outfit that was projecting an almost $US 2 TRILLION budget surplus during Mr Bush's first term.

A Recipe For Others:

In the days when the International Monetary Fund (IMF) was still a functional entity which carried some clout in the world, it had a standard recipe for nations which it was proposing to bail out after they had got themselves into a financial tangle through profligate borrowing and spending. It was known as the "Washington Consensus" and included a number of items.

Among these standard items were fiscal policy discipline, redirection of public spending from subsidies, tax reform, market determined and positive real interest rates, competitive exchange rates, trade liberalisation, liberalisation of inward foreign direct investment, privatisation of state enterprises and deregulation. As The Privateer pointed out many times during the years when the IMF was enforcing these items, the primary goal was never to get the nation (or nations) back on its feet as an independent entity, it was to safeguard the "investments" of the western banks which had in most cases precipitated the collapse by lending to the governments of the nation in strife.

This "Washington Consensus" has never been applied to Washington (DC) itself. A year into the global credit crunch, the time is getting closer when it will be. This will not happen because the people in Washington and on Wall Street see the error of their ways and resolve to straighten up and "fly right". It will come because there is nothing else they can do. When taxes can be raised no higher and debt paper can no longer be sold either inside or outside the country which issues it, there is nothing else to do but to spend less - MUCH less. The alternative is to face a time when you have to knock ten "ZEROS" off your currency. Zimbabwe just did that, on the same day as Mr Bush was signing the "housing bill".

The Approaching Buyers' Strike:

The latest figures on global buying of US government and "agency" debt paper is an advance warning of what is to come. While global buying of US Treasury debt paper was still increasing, global buying of "Agency" (read Fannie and Freddie) paper actually FELL. Now, as analysed in the Global Report, the US Treasury has been set up as a "captive buyer" of this paper. The current Treasury debt limit is about $US 1.1 TRILLION above the current level of Treasury debt "subject to limit". The rest of the world combined holds about $US 1 TRILLION of Fannie and Freddie's paper.

For many decades now, the unwritten rule enforced by Washington and abided by all over the world has been that nobody does anything to "rock the boat" while the US is in the throes of an election, especially a Presidential election and "extra especially" a Presidential election in which the incumbent is not participating. That may (we repeat - MAY) hold up this time around. If it does, then any concerted "buyers' strike" of US Dollar denominated paper may hold off for most of the rest of this year. If it doesn't, such an event could happen at any time from now on.

On US stock markets, the Dow confirmed a bear market a month ago on July 2 when it closed more than 20 percent below the high it set back in October 2007. So far, the US stock markets have not deteriorated further. There was one close below the 11000 level on the Dow in the middle of last month but the US markets were then resuscitated by the hoopla leading up to Mr Bush signing the housing bill.

The big news on global markets over the past week is the HUGE correction in global commodities prices. The oil price, for example, fell almost 16 percent over the last two weeks of July. Over July as a whole, the Commodity Research Bureau (CRB) index had its biggest monthly fall for 28 years, since March 1980. The initial "flight into real goods" is being overwhelmed by the deflationary pressure of ever accelerating debt write-downs. The REAL flight into real goods - and into real MONEY - is yet to begin.

Gold:

What's Next?:

With the breakdown of the WTO talks in Geneva on July 29, yet another attempt (this one seven years in the making) to at least give lip service to the concept of "free trade" has come to nothing. The last thing that the world needs now, on top of the credit crisis, is an outbreak of "trade wars".

The Beijing Olympics begins on August 8 and runs until August 24. This is China's great global showcase and has been anticipated for years. One can be sure that there will be nothing done by the Chinese government during this period to roil global financial waters. After August 24, that changes.

The SEC in the US has extended their recently announced rules banning "naked short" sales of Fannie and Freddie and seventeen other "too big to fail" US financial stocks until August 12. But, they have also stated that they are NOT going to extend their ruling beyond that date.

Europe, as it always is at this time of year, is on "vacation". In the US, Washington DC is bracing itself for either the next "regulatory emergency" or the start of the Presidential campaign in earnest - whichever comes first. The kickoff for the Democratic convention is August 25 - the day after the Olympics ends.

No comments:

Post a Comment