Fat Profits, But Big Oil is Shrinking

Published by Andy Rowell February 1st, 2008 in Big Oil Profits, oil industry outlook, coal to liquids, oil reserves Tags: Big Oil Profits, coal to liquids, oil industry outlook, oil reserves.  Over the next few days more oil companies will announce obscene profits.

Over the next few days more oil companies will announce obscene profits.

But as the headlines are taken by calls for a windfall tax, the real story is one that has been brewing for some time. Big Oil can’t find enough oil. Yesterday, despite making £93m a day, Shell did not impressed the markets. The company’s shares ended the day flat at 1791p.

As the Independent explains: “The market’s tepid response can be explained in part by the fact that Shell and its rivals are facing a difficult future as they seek to slake the world’s thirst for oil amid a rising tide of resource nationalism and soaring costs of extraction.”

“At Shell, production is falling, by about 1 per cent last year and, by Mr van der Veer’s estimation, around the same this year and the next until some very large projects, such as Sakhalin 2 in Russia and the massive Pearl gas-to-liquids project in Qatar, begin operating. Most of its big projects will not begin to bear fruit for five or seven years yet and will require a huge amount of cash to get off the ground.

The spending increase is indicative of a fundamental shift affecting the entire industry. According to research from Deutsche Bank, oil companies spent a combined $250bn to produce 30 million barrels of oil per day in 2002. By 2006, the industry spent $550bn to get just 20m barrels per day. While part of that change can be explained by cost inflation, the fundamental reason is that most of the easy oil – close to the surface and relatively straightforward to extract– has been found.”

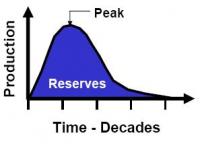

Mr van der Veer reiterated his view yesterday that by 2015 the world will have reached peak “easy oil”, which is why the company has plunged headlong into much more expensive, technologically challenging areas such as oil sands and deep-water drilling. Derek Butter, of Wood Mackenzie, said: “People are accepting that higher oil prices are here to stay, maybe not at $90 per barrel, but probably at $60 a barrel. So what were marginal projects that need a high price to achieve to return are getting the green light.”

The Wall Street Journal also covered this issue yesterday of not enough oil left. “They simply don’t have enough lucrative opportunities to invest,” Fatih Birol, chief economist of the Paris-based International Energy Agency told the paper. “They’re investing more to slow down the decline in their existing fields than in new production.”

As the paper said:

Big Oil is Shrinking.

No comments:

Post a Comment